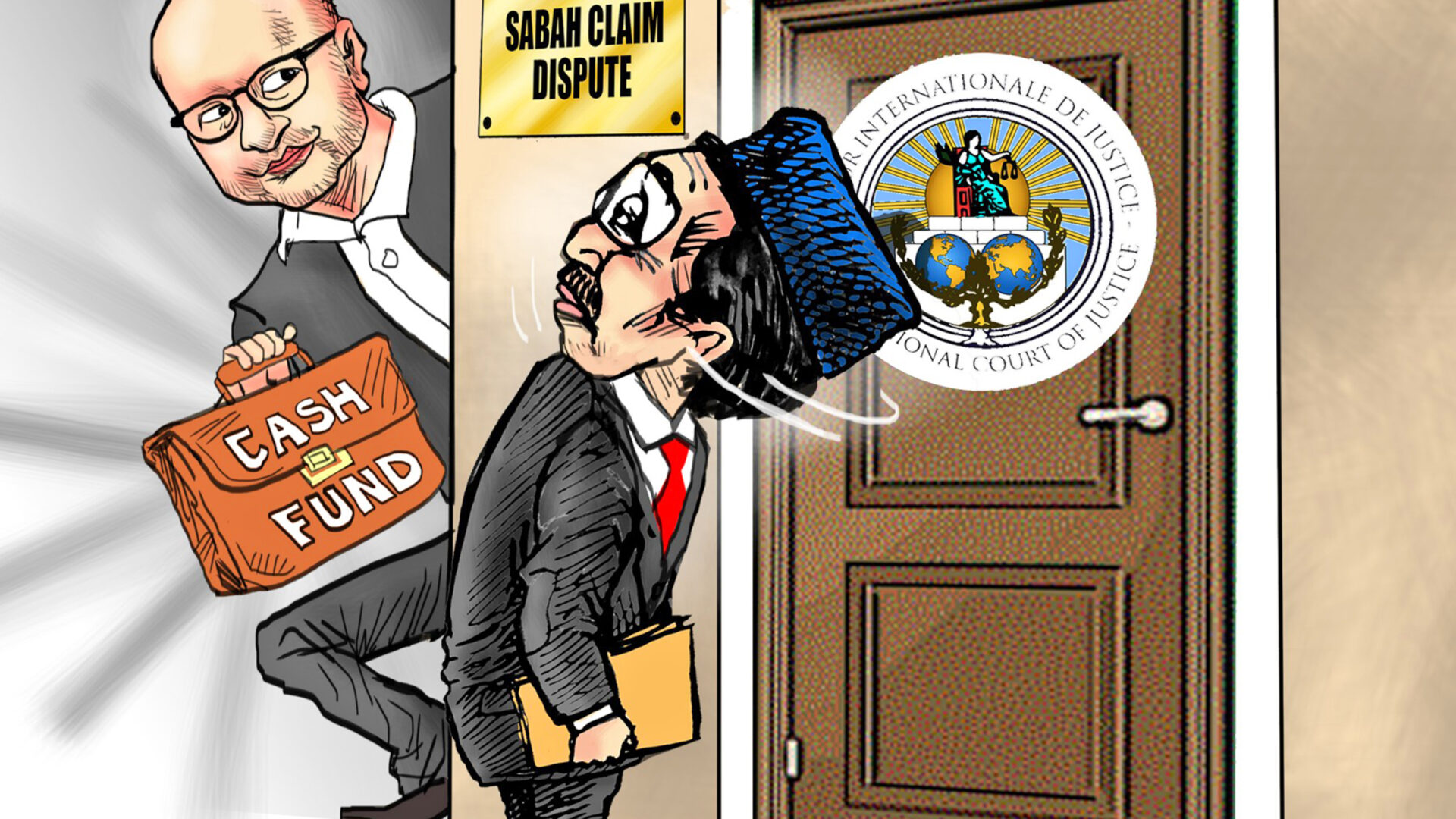

Malaysian political types are pointing to global legal action funder Therium Capital as providing the financial muscle to the successful litigation of the Sulu Sultanate’s demand for compensation, following the breach of the 1878 contract between the Sultanate and the United Kingdom-backed trading house British North Borneo Co., a deal which Malaysia inherited after gaining independence in 1963.

Former Malaysian attorney -general Tan Sri Tommy Thomas had sought an investigation of Therium after it allegedly plunked in more than $10 million into the Sabah arbitration case, mainly to pay for attorney’s fee.

“We must seek advice from the best barristers in London (on the assumption Therium carries out its business in the United Kingdom) whether Malaysia can seek an injunction against Therium restraining it from further funding,” Thomas said.

“Once the money flow ceases, amazingly the rogue arbitration activities will cease,” according to Thomas.

In March 2019, Therium announced its latest fund of £325 million, which brings its total funds raised to over $1 billion. To date, the firm globally has funded claims valued at $36 billion.

The firm’s online site indicated that its specialty is in developing “innovative funding arrangements and bespoke financial solutions for litigants and law firms,” which complements “its unmatched experience and rigorous approach to funding a wide range of commercial disputes in varying jurisdictions throughout the world.”

Neil Purslow, co-founder and Chief Investment Officer of Therium, was recognized as a leading individual in litigation funding.

Its war chest seems formidable. It boasted “deployed capital” at around $1 billion and a strong track record of litigation investment across 12 funds.

A legal eagle in Malaysia said the mere fact that Therium is funding the Sulu Sultanate’s complaint in the arbitration proceedings indicates that it considers the Sabah claim as having a strong chance of winning.

“You may call Therium whatever you want, but they obviously think the descendants of the Sultan of Sulu have a case, or at least will be able to extract something substantial from Malaysia,” the sources said.

More transport please

The local economy is expected to fully reopen under the “new normal” when schools reopen for actual classes late this month, which spurred calls from transport advocacy groups for the government to undertake actions in raising the capacity of public transportation.

The commuters group The Passenger Forum (TPF) asked the Land Transportation and Franchising Regulatory Board to raise the cap for Transport Network Vehicle Service (TNVS). TNVS is otherwise known as a ride-hailing service that includes Grab for automobiles and Angkas for motorbikes.

Lately, these service providers have been under fire for the fare surges during difficult hours of the day. At times the amount becomes prohibitively high to the consternation of commuters.

TPF convener Primo Morillo said the price surges are the function of the law of supply and demand, which can be addressed by allowing more TNVS units to ply the streets.

“Less price surges and lower rates could convince car owners to book TNVS services instead of using their own cars. Commuters who can afford lower TNVS rates may also choose this option and could effectively lessen the demand for mass transport,” Morillo added.

A June 2019 online survey showed 78 percent of TNVS passengers suffered more frequent and expensive fares due to surge pricing and 72 percent experienced difficulty in booking a unit. The survey was conducted 14 to 15 June 2019 after the LTFRB’s mass deactivation of TNVS units in 10 June 2019.